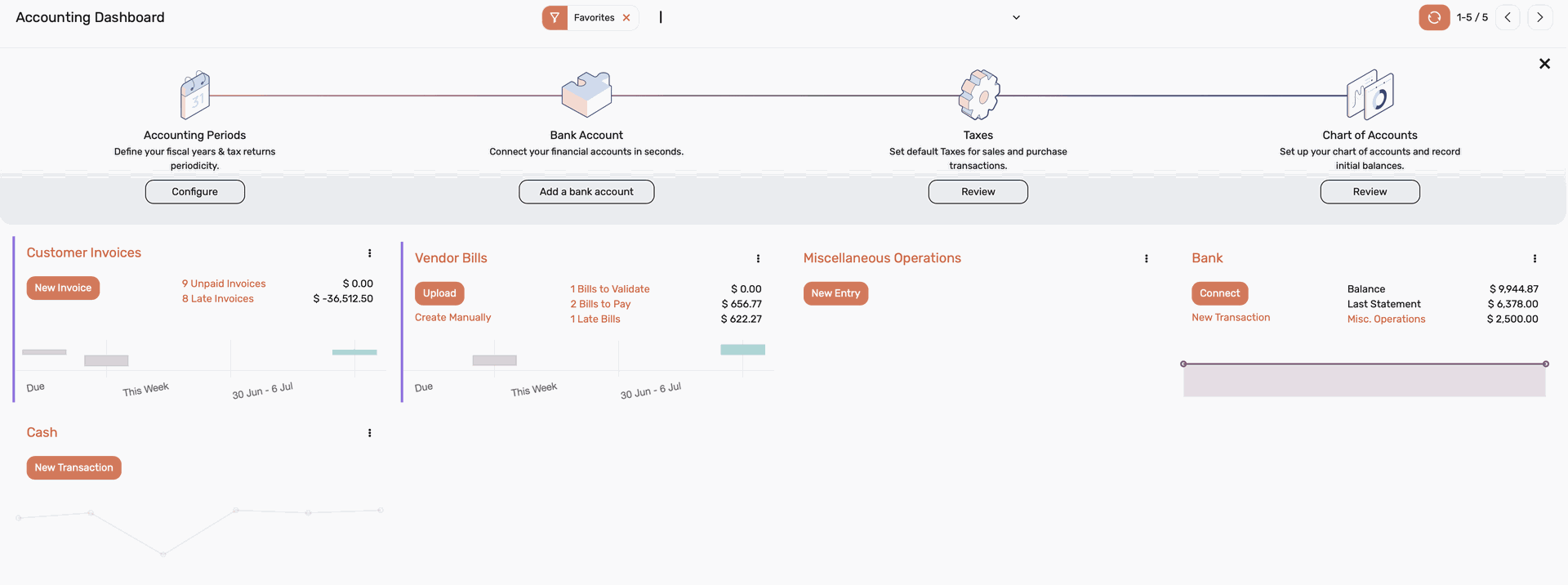

Accounting & Tax

Manage financial documents for accurate submission and record accounting data to report organization's general expenses.

Account Receivable

Cover deferred revenue recognition, invoice creation and delivery. Manage tax invoices and credit/debit notes to adjust payable amounts.

Record customer payments and issue receipts upon receipt of payments.

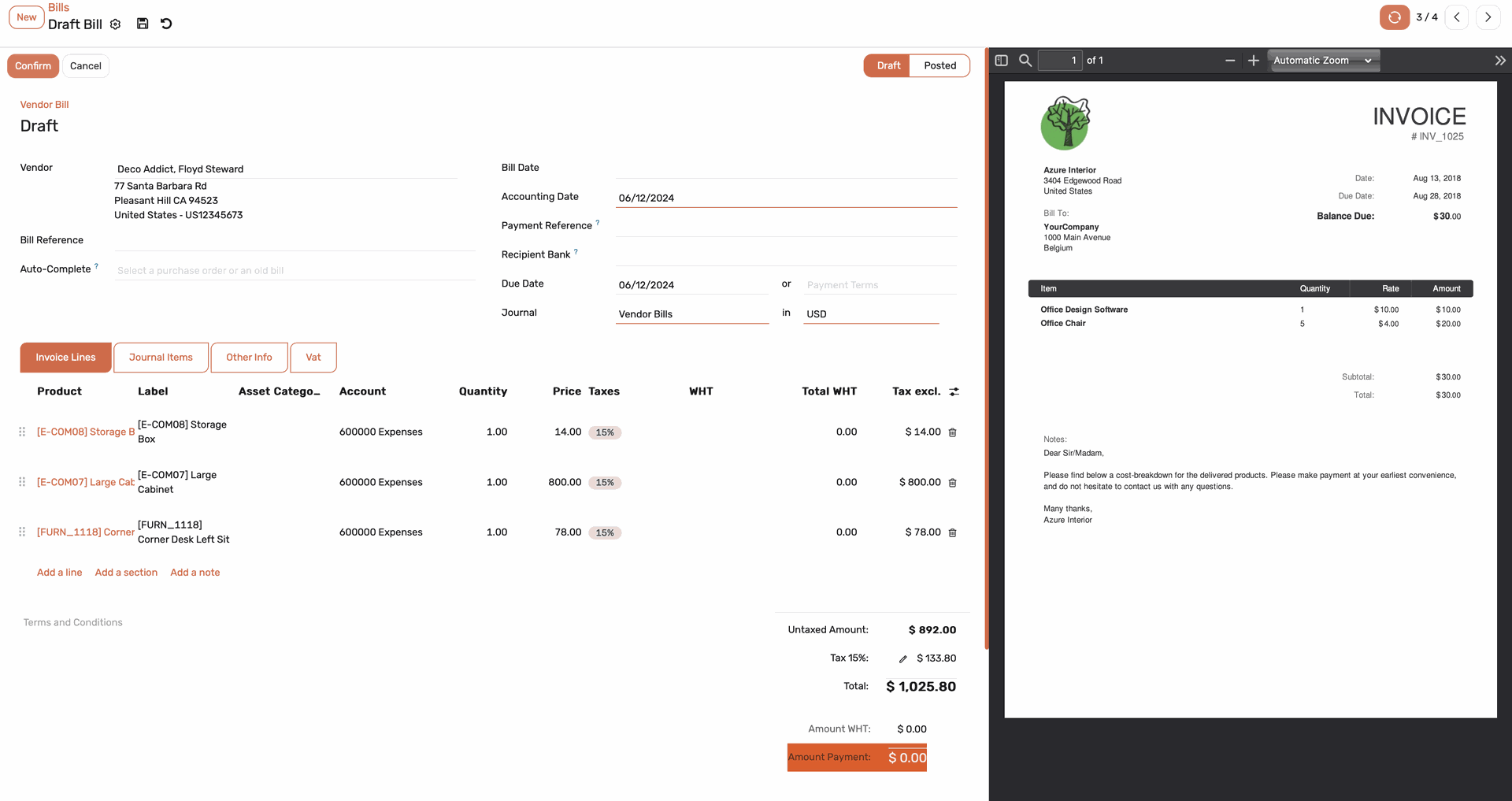

Account Payable

Handle deferred expenses, recording and managing documents specifying payable amounts.

Include adding or modifying information regarding invoices or billing. Manage credit/debit notes, withholding tax documents, and updating tax information.

Set payment and credit terms for transactions. Check and track the status of invoices or bills.

Cover all financial variables

Assist in allocating and planning the organization's budget. Manage cost center data and analyze financial information from accounts.

Support transactions in multiple currencies as per the Bank of Thailand's (BOT) specified rates.